I hope you’ve enjoyed the Moolah Mondays series and benefited from hearing about the system and methods I use and recommend. In wrapping up, here are some thoughts about money and giving by a long time friend of mine and fellow author, Gabriel Aviles.

If you were one of the 111.5 million people who watched Super Bowl XLVIII between the Seattle Seahawks and the Denver Broncos you witnessed not only a big victory for Seattle, but also the half-time show featuring Bruno Mars and the Red Hot Chili Peppers. The Chili Peppers performed one of my all-time favorite songs, “Give It Away, “a celebration of living a life of generosity and love.

Along with the Red Hot Chili Peppers, it seems that many Americans love to give. In fact, according to the Giving Institute’s “Giving USA” 2014 report, charitable giving exceeded $335 billion in 2013, up from $316 billion 2012!

Of course, this is not the case with all of us. Many of us hold back. Yes, we have that built-in desire to help people. We want to give to great causes, but these nice thoughts don’t always translate into action.

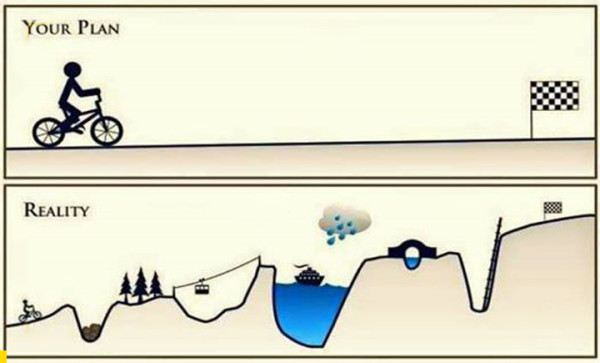

The reasons for not giving are many. First of all, we don’t see how we could possibly afford giving when we’re barely paying our own bills. We fear that if we give, we won’t have enough to cover our own needs. Some of us may not give because we are stuck in analysis paralysis. With so many good causes out there, we can’t seem to decide where to give. Others of us who are barreling forward with eliminating debt, saving, investing, and building towards a financially secure future, can’t get our heads around giving. It seems counterintuitive to give when we are determined to “get our own house in order.”

Finally, there are others of us who look to those appearing more fortunate than us to do the giving. Why should we be the ones to sacrifice when there are others, in our estimation, that can really afford to give? While these concerns and ideas may have merit, let’s explore what the Bible says about generosity and giving.

The principle of giving, specifically of giving to the needy, is foundational to the Bible. In the Old Testament, giving to the poor was part of the “Feast of Weeks,” a celebration of the first fruits of the wheat harvest. Part of this important celebration included field owners leaving the edges of their field unharvested and allowing remaining useful parts (“gleanings”) to remain after harvesting so that the poor could take them.

In the New Testament, we also find the principle of giving to those in need. In Luke 3:11, John the Baptist tells a crowd to share their food and clothing with those who need them, while in Acts 20:35, Paul also reminds us to help the impoverished and adds that it is better to give than to receive. Finally, in Matthew 22:37–40, Jesus also reminds us to love our neighbor as ourselves. In other words, if we wouldn’t let ourselves go hungry, we shouldn’t let our neighbors go without either.

Sometimes we want to give but are discouraged by the fact that we can’t give much. Once again, we can turn to the Old Testament Jewish feasts (Deuteronomy 16:13–17.) During these three feasts, God asks the men to bring a gift in proportion to the way that God had blessed them. In other words, even though He expected more from those that had more to give, the expectation was that everyone should contribute!

While we don’t give to the poor to get back, the Bible tells us that if we give, God will help us when we are in trouble. Scripture states that God will protect us from our enemies; he will preserve our lives, and restore us to full health.

Solomon, the wisest man who ever lived (and King David’s son), also gives us insight into the rewards for those who give to the poor. In Proverbs 11:25, he tells us that “a generous person will prosper.” Chapter 19:17 also says that God will reward us for lending to the poor, while in the New Testament, Paul adds that the generous will be made “rich in every way,” (2 Corinthians 9:10). So think about yourself. When was the last time you gave of your time or money? What holds you back from giving?

– Gabriel Aviles, author of the forthcoming book Man Upstairs LifeHacks: Money – A 60-Minute Beginner’s Guide to Rethinking Your Personal Finances (due Spring 2015)

manupstairs.com (coming soon)

Connect with or email Gabriel at Twitter: gaaviles@comcast.net

Don’t miss a thing. Subscribe to receive updates by email.