They say sex and money are the top two things couples fight over. So let’s talk about money. Managing your money well can do several things for you:

- Reduce stress

- Pay off debt

- Avoid new debt

- Help you save for things you want like a vacation, new car, a child’s college fund, or Christmas gifts

Several months ago my post about 7 things you need to do right after a layoff touched on budgeting. Budgeting is so important whether you are in transition or not—and can be fun! In this new series, Moolah Mondays, I’m going to share the system I came up with and have used for years to successfully budget and manage my finances.

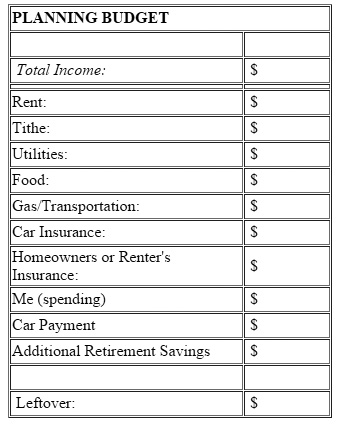

First, make a Planning Budget (click the link to download a template in MS Word). This will show your regular expenses/recurring bills. The fun part is you’ll end up knowing how much discretionary income (leftover money you can use for things you want) you have when you’re done. The Budget is based on your total net (after taxes, withholdings, benefits, etc.) income from all sources each month—Just use a best guess estimate if you are on commission or have income that varies. This will be a simple table and look something like this:

Second, make a paper Tracking Budget. This is like a Checkbook Register but better! Here, you’ll enter what you’ve made (have to spend) and spent (subtracting what you bought) We’ll go into more detail on this tool later in this series, but here’s a sample in use.

- Rent: $500 -$500 (Nov.)

- Tithe: $200

- Utilities: $200 -$100 (cell) -$60 (internet) -$15 (water)

- Food: $150 – $75 (Nov 1)

- Gas: $100 -$35 (Oct 1) -$35 (Oct 8)

- Car Insurance: $200 + $200 + $200

- Homeowers Insurance: $100 + $100 + $100

- Me (spending): $300 -$20(ATM) -$25 (dogfood) -$35 (watch) -$5 (lunch)

- Car Payment: $300

- Retirement: $400 + $300 + $400

- Vacation: $100 +$200 +$150

- Credit Card: +$100 + $60 + $35 + $35 + $25 + $35

Next, let’s do a fun one…keep a Wantlist. Here you can plan to make dreams a reality. I like to keep mine in Google Drive as a Google Document. Your Wantlist could look something like this:

- $1500 – Trip to 20th Class Reunion

- $500 – 50” flat panel TV

- $800 – Cindy’s prom dress

- $200 – My birthday party

Last, keep a list of Yearly Expenses; sample below. I recommend a Google Document for these too. With this, you can keep an eye on things that you regularly expect (or might forget!) during the year for which you’ll need money. You can use things like your discretionary income, tax return, work bonuses, airbnb.com earnings, or 5th week paychecks to cover or get ready in advance for these expenditures.

- Jan – Property tax

- Feb – Vacation (final bit of funds)

- Mar – Cindy’s birthday gift

- Apr – Mothers Day gift

- May – Fathers Day gift

- Jun – Wash/Wax/Detail the car

- Jul – Car alignment

- Aug – (nothing/TBA)

- Sep – Car emissions inspection and license plate

- Oct – Christmas gifts

- Nov – Parent’s anniversary gift

- Dec – Termite treatment

Now that you’re armed with the right tools, next we will talk more about how to use them.

If you have children, friends, or family that would benefit from this blog, please share it. And don’t miss the next topic in this series! Sign up for this blog–see the box at the top right of this page.